TDS, which is short for Tax Deducted at Source, is a way of collecting tax in India from the very source of income. The payer has to deduct the tax from the total amount before paying to the payee and that tax is sent to the Income Tax Department. The amount of TDS deducted from your total amount is recorded on your PAN. You can later claim your TDS credit while filing an ITR (Income Tax Return) and get back your money.

Whether you are a salaried person or you receive rent, interest, or commission for freelancing work, your payer will deduct TDS from the total payable amount. To know if the payer has recorded TDS against your PAN account, you will need to check your TDS credit. This can be done online now using the Income Tax portal and TDS-CPC website. In this article, we have shared a detailed step-by-step guide on both these methods. Without further ado, let’s get started!

Table of Contents

Basic requirements to check TDS credit

Here are a few basic things you will need to check your TDS credit –

- PAN (Permanent Account Number) – You can find this on your PAN card. You might be interested to read our guide on how to download e-PAN online as a PDF file.

- Registered mobile number – You will receive an OTP on the phone number which is registered with your PAN. This is done for the verification purpose.

- TAN of deductor – TAN stands for Tax Deduction and Collection Account Number. You can ask this from your payer.

Check TDS status using Form 26AS

- Launch any web browser on your PC such as Chrome and visit the official e-portal of the Income Tax Department.

- If you already have an account on the Income Tax website, simply log in to your account. If you are a new user, tap the Register button and then complete the registration process to create your account. You will be asked to provide the basic details of your PAN card. For the verification, you will receive an OTP on your registered phone number. Once your account has been created successfully, login into your dashboard.

- From the menu, go to e-File > Income Tax Return and click on the View Form 26AS option.

- Now you will see a disclaimer on your screen asking you to confirm the redirection to the TDS-CPC website. Tap the Confirm button to continue.

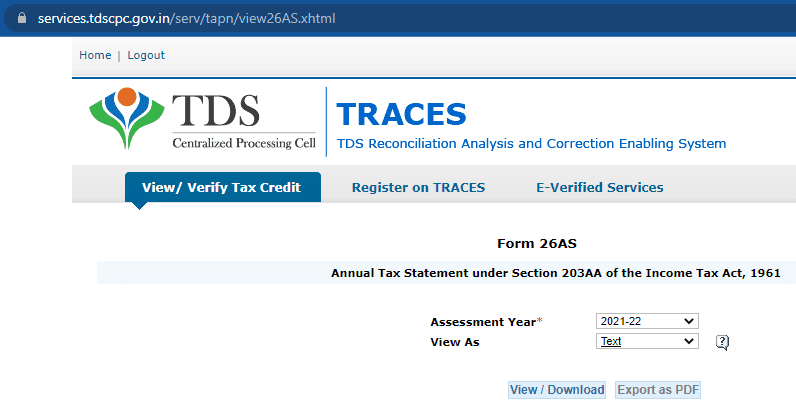

- In the next step, you will be redirected to the TDS-CPC website. Click on View Tax Credit (Form 26AS) link.

- Select the assessment year for which you want to check your TDS and choose the file type. You can view the data in HTML, text, or PDF format. After that, click “View / Download” or “Export as PDF”.

- Open the downloaded file and you will be able to see all the details of your TDS credit. To get your TDS money back into your bank account, you can file an ITR (Income Tax Return).

Please note that this method may not work on some mobile browsers like Safari. You will probably get stuck in the fourth step while opening the redirection link. We recommend using your PC and Chrome browser for this method.

Check TDS credit using your PAN card

- Visit the TDS-CPC website at tdscpc.gov.in by using any web browser on your smartphone or PC. You will get a pop-up box on your screen listing some points of caution. Tap the Continue button.

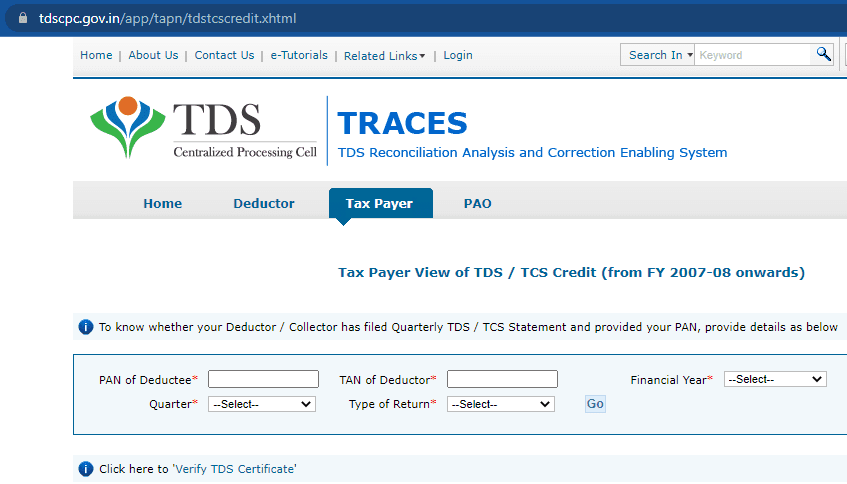

- From the website menu at the top, navigate to the Tax Payer section. After that, choose the “View TDS / TCS Credit” option from the Quick Links section on the left-hand side. Alternatively, you can directly visit this webpage by clicking on the above link.

- Now enter the text shown in the captcha image for verification and tap the Proceed button.

- In the next step, you will be asked to provide the following details: PAN of deductee (i.e. your PAN card number), TAN of deductor (i.e. TAN number of the company who deducted your money), financial year, Quarter, and Type of Return (Salary or Non-Salary).

- After filling these details, tap the Go button and you will be able to see your TDS credit within no time. In the same way, you can also validate the TDS certificate issued by your deductor. Simply, click the “View TDS certificate” link in the 4th step.

Frequently asked questions

A TDS return is a statement or report filed by the deductor (payer) to the Income Tax Department. It contains details of TDS deductions made from payments to various parties. This return includes information about the deductee (recipient), the amount deducted, and other relevant particulars.

To get a TDS refund, you need to file an Income Tax Return (ITR). When your TDS deducted by payers exceeds your actual tax liability, you can claim a refund. The excess TDS is returned to you by the Income Tax Department after processing your ITR.

Form 26AS is a statement that shows the details of TDS deducted by various payers on your income. It is accessible online through the Income Tax Department’s website or TRACES portal. Form 26AS helps you verify the TDS amount deducted and ensure it matches with your actual income and tax liability.

If your TDS credit is not showing in Form 26AS, it may be due to delays in data entry or reporting by the deductor (your payer) to the Income Tax Department. It’s essential to confirm with your deductor that they have correctly filed and reported the TDS deducted against your PAN. If the issue persists, you should consider contacting the Income Tax Department for resolution.

Conclusion

So these were two simple methods to check your TDS credit online. If you want to get the data for the whole financial year, you can use the form 26AS on the Income Tax online portal. This method doesn’t require you to provide any details as everything is already linked to your PAN account.

On the other hand, if you want to check the status of a particular TDS, you can use the second method where we have used TDS-CPC website. In this method, you have provide the your PAN number and TAN of the deductor. If you you want to ask something about this tutorial, feel free to share it in the comments below.

Read other similar articles:

- How to Check PAN-Aadhaar Card Link Status Online

- How to Download Voter ID Card Online (Print PDF)

- How to Link Voter ID With Aadhaar Card

- How to Change Phone Number in Aadhaar Card

- How to Check SBI Account Balance