Know the step-by-step guide to find if your Aadhaar card and PAN card are linked with each other. This guide will show you how to check your Aadhaar-PAN link status online. There are 2 different ways you can do this by using the Income Tax Department website or via SMS.

Aadhaar card and PAN card are two most important documents for Indian citizens. Aadhaar card is most commonly used as proof of identity, whereas PAN (short for Permanent Account Number) is used for filing taxes and other financial purposes.

The Income Tax Department has made it compulsory to link your PAN with Aadhaar card. Most of the people already have them linked from the time when they applied for the PAN card. If you don’t know whether your PAN is linked with Aadhaar card, we will show you different ways to find that out.

Table of Contents

PAN Card-Aadhaar Card Link Status Overview

The following table shows an overview of PAN-Aadhaar link status –

| Service | Link Aadhaar Status |

| Purpose | To check the link status of PAN with Aadhaar card |

| Requirements | PAN number and Aadhaar number |

| Service provider | Income Tax Department |

| Authorised by | Government of India |

| Fee | Free |

| Methods | Online and SMS |

| Online portal | Income Tax Department |

| Official website | incometax.gov.in/iec/foportal/ |

| Contact | 1800 180 1961 |

How to check PAN-Aadhaar card link status online via the Income Tax website

The easiest way to know if your PAN card is linked with Aadhaar card is by using the Income Tax Department website. It has the facility to check PAN-Aadhaar link status online for free.

You only need to provide your PAN number and Aadhaar number. The website will match your details against its database and then show you a message regarding whether or not your documents are linked.

Here’s a step-by-step guide for this method –

- Visit the Income Tax Department website on your PC or smartphone at incometax.gov.in/iec/foportal/ address. Use any web browser such as Chrome or Safari.

- Click on Link Aadhaar Status option under Quick Links on the left sidebar.

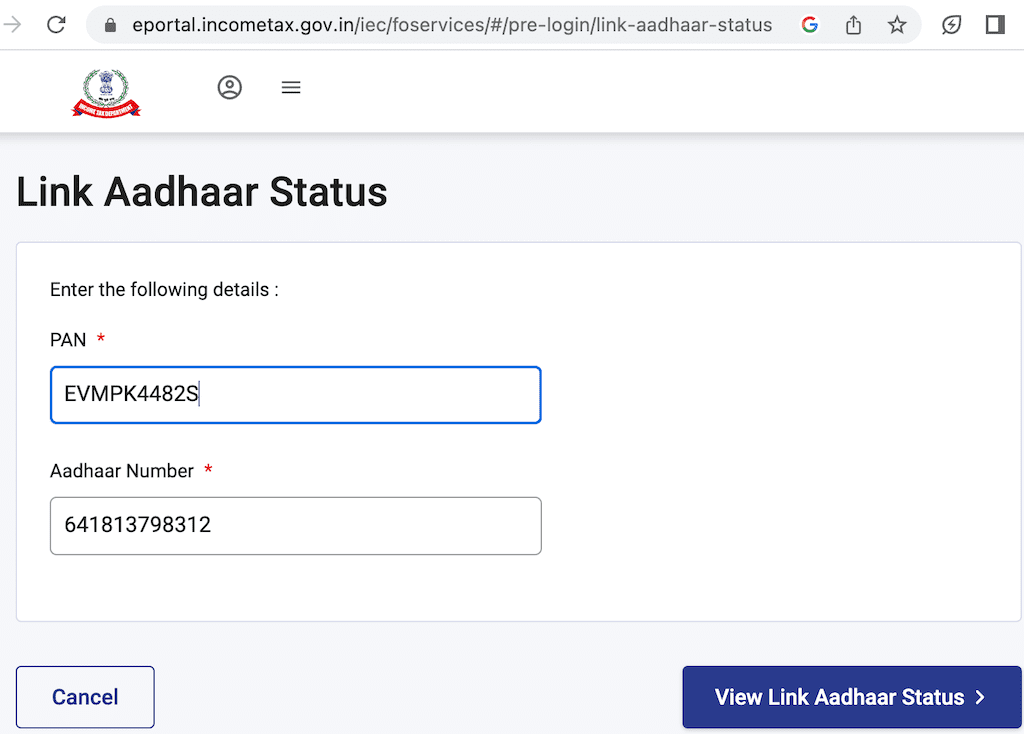

- Now enter your PAN number and Aadhaar number in the given fields. A PAN number is a 10-digit alphanumeric code that you can find on your PAN card. Whereas, the Aadhaar number is a 12-digit unique identity number that is printed on your Aadhaar card.

- Tap on View Link Aadhaar Status button.

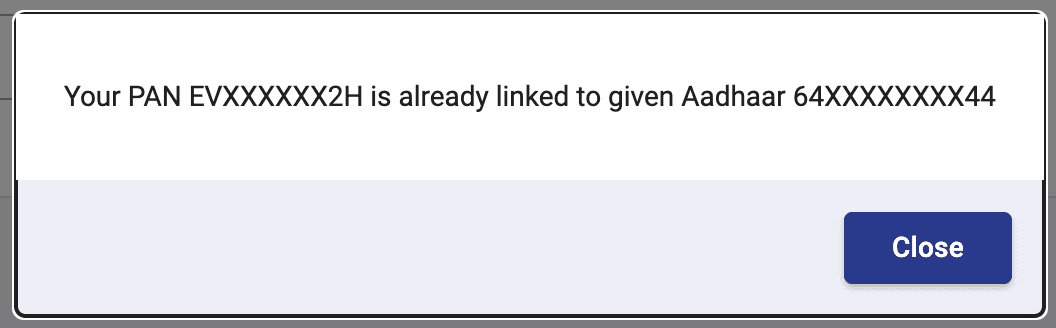

- Now it will display your PAN-Aadhaar link status in a pop-up box.

- If your Aadhaar card and PAN are already linked, you will see a message that says “Your PAN EVXXXXXXXX is already linked to given Aadhaar XXXXXXXXXXXX“.

- If they are’nt linked, the pop-up message will display this “PAN not linked with Aadhaar. Please click on Link aadhaar to link your Aadhaar with PAN.“

Note: If you have submitted a request to link your PAN with the Aadhaar card recently and your request is still under process, it will show the following message on your screen “Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on Link Aadhaar Status link on Home Page.”

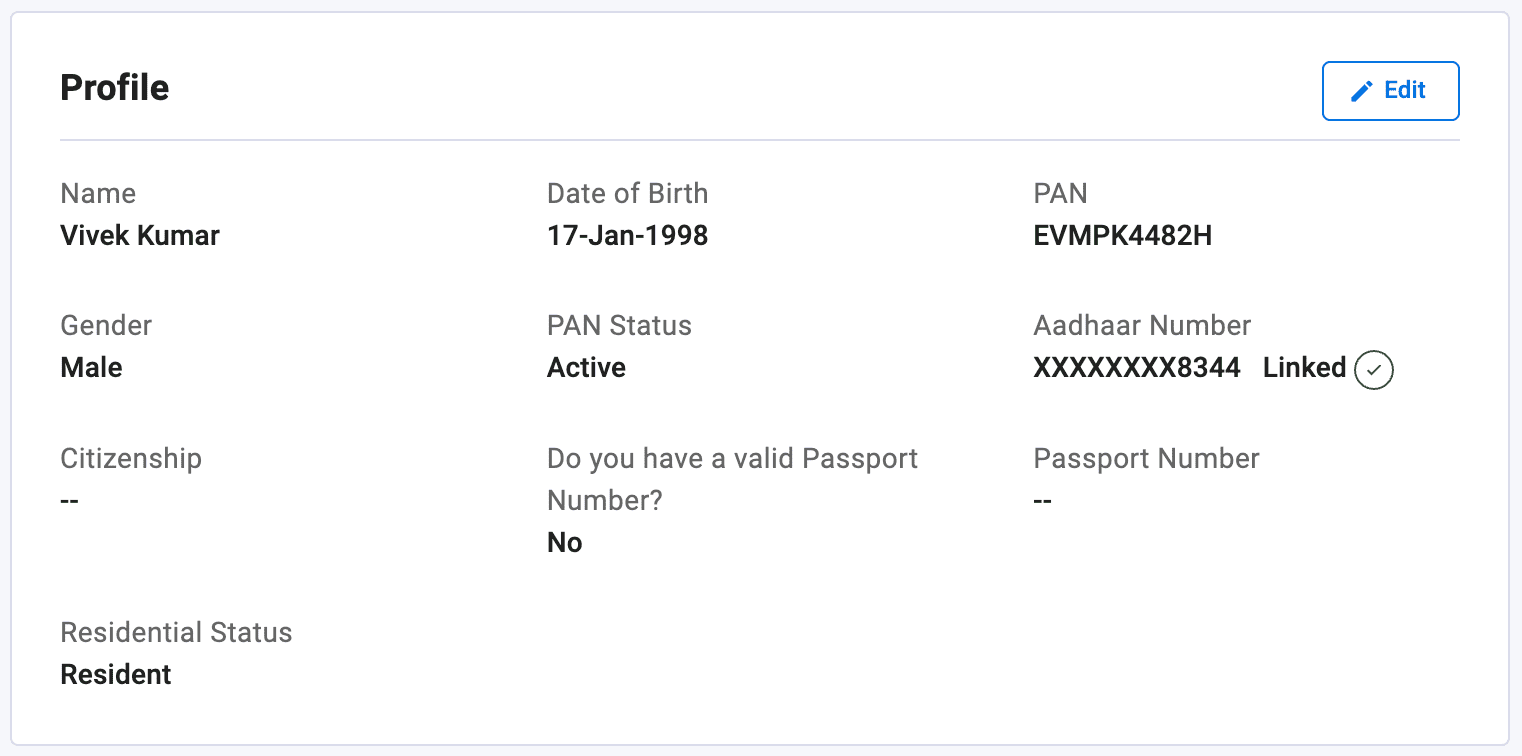

Check Aadhaar-PAN link status by logging into your Income Tax account

There is another way you can check your Aadhaar-PAN link status by using the same Income Tax Department website. This will require you to log in to your e-Filing account. If you are an existing user on this website, you can use this method to know whether your PAN is linked with your Aadhaar card. Here are the steps you need to follow –

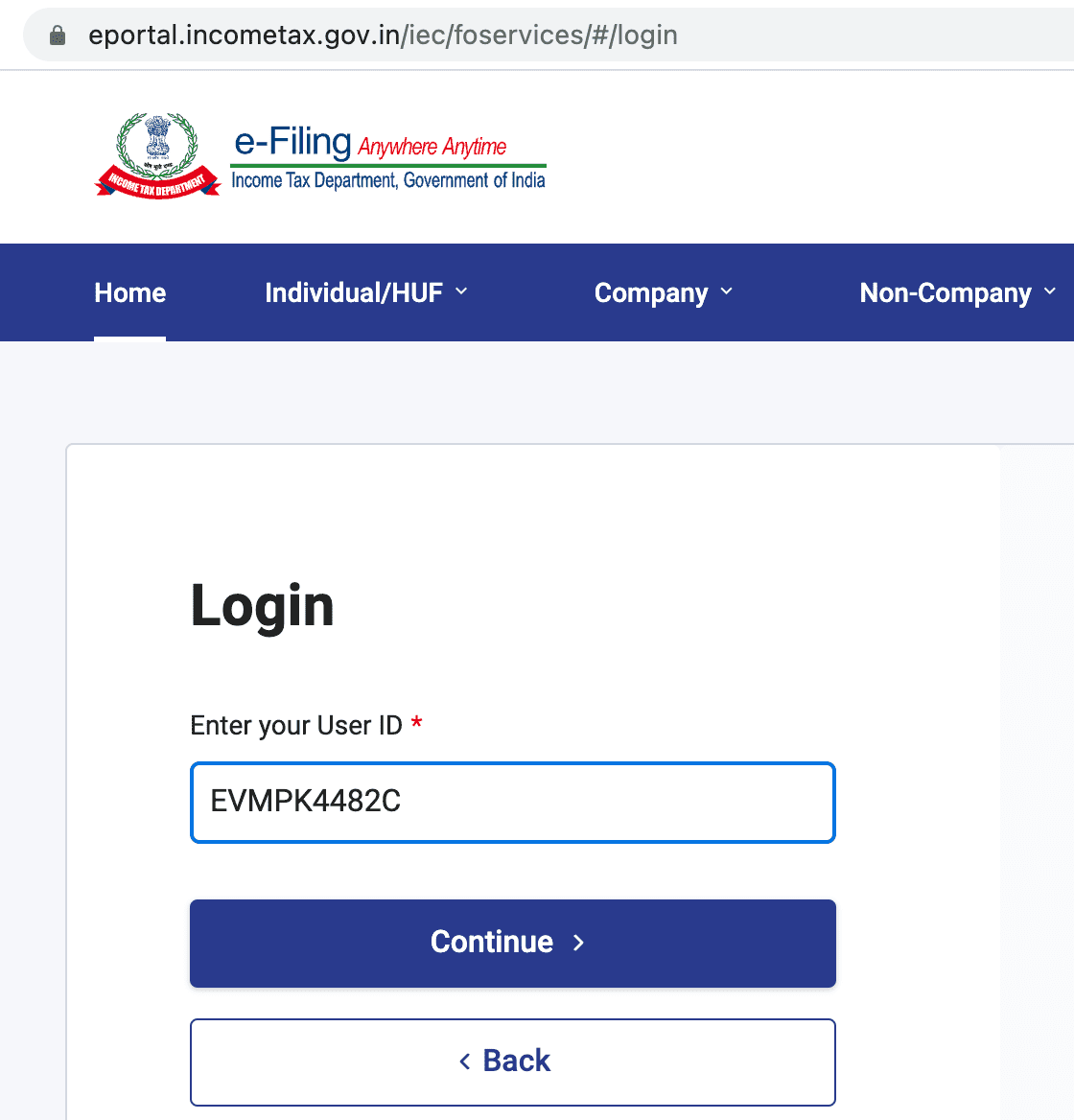

- Visit the Income Tax e-filing portal.

- Navigate to the Login page and sign in to your account using your user ID and password.

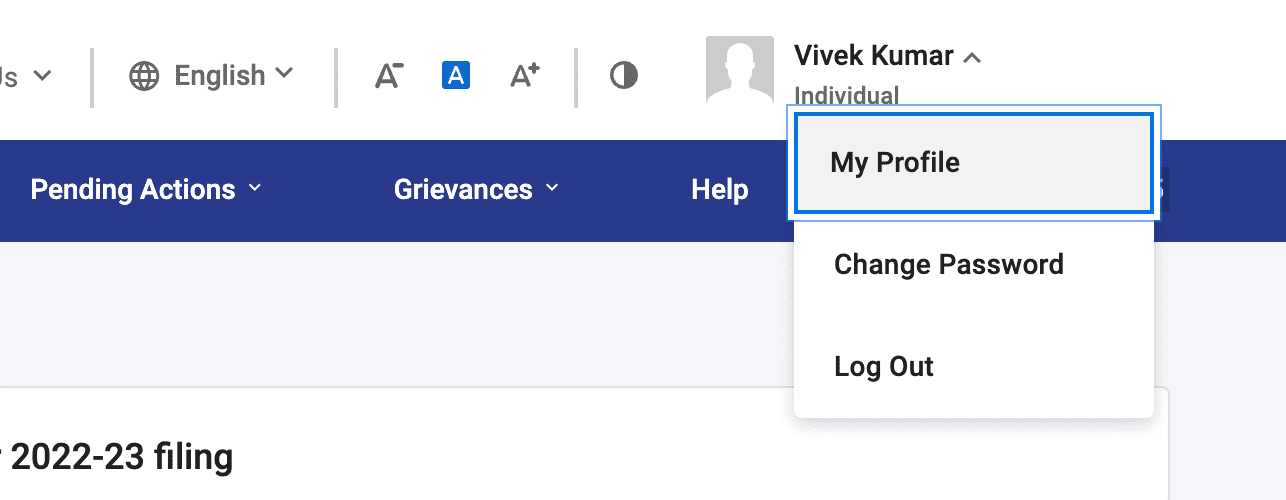

- Once you are logged in, tap on your name in the upper-right corner and go to My Profile.

- Now look for Aadhaar link status under Profile section.

- If it shows Linked status, that means your PAN is already connected with your Aadhaar card. You will also see the last 4 digits of your Aadhaar number.

- In case your PAN is not linked, it will show you an option to link your Aadhaar card. If you have already requested for the same, it will validate your details with the UIDAI Aadhaar database. This may take some time to process so if your request is still pending, you will need to check back later.

How to check PAN-Aadhaar card link status via SMS

Another simple way to check your PAN-Aadhaar link status is via SMS service. This method is more convenient and can be used even without an internet connection. Here’s what you need to do –

Send a text message in the format “UIDPAN <12 digit Aadhaar number> <10 digit PAN number>” without quotes to 567678 or 56167.

PAN-Aadhaar link status via SMS

After sending this SMS, you will get a response back. This response will have information about your PAN-Aadhaar link status. If both these documents are already linked, you will get the following message – “Aadhaar is already associated with PAN XXXXXXXXXX in ITD database. Thank you for using our services.“.

FAQs on PAN-Aadhaar Link Status

There is a deadline declared by the Income Tax Department. If someone fails to link their PAN with their Aadhaar card before a specified time, they will incur a penalty of ₹1000 to link both documents in the future. Failing to do so will also lead to their PAN being inoperative.

The last date to apply for linking your Aadhaar with your PAN card was 30 March 2023 previously. The Income Tax Department has now extended this date to 30 June 2023. If you don’t apply before that, you have to pay an extra ₹1000 fee later.

There is no fee for this service. The PAN-Aadhaar link status can be checked online for free from the official website of the Income Tax Department. Alternatively, you can send an SMS from your registered phone number to do the same.

To link your Aadhaar and PAN card, first visit the official e-filing website of the Income Tax Department of India. Then, click on the “Link Aadhaar” option from the Quick Links panel and enter your Aadhaar and PAN card details. Finally, click on Validate button and then verify OTP to complete the process.

Yes, it is mandatory to link your PAN card with your Aadhaar card as per the Income Tax Department’s directive. This has been to done before 30 June 2023 which is the last deadline. If you don’t link the two documents, your PAN card will become invalid or inoperative, which could lead to other financial issues in the future.

This is an unusual case. If you see a message saying that your PAN card is linked with some other Aadhaar card, then check your PAN number and Aadhaar number. This problem usually occurs when you enter incorrect information. If the problem still persists, you need to submit a request to your Jurisdictional Assessing Officer to delink your PAN card.

Wrapping up

So that’s more or less everything you need to know about PAN-Aadhaar link status. Through this guide, you have learned how to check if your PAN card is linked with your Aadhaar card. We’ve highlighted two ways for you to do this, including via the Income Tax website and SMS. If you want to ask any questions about this topic, let us know in the comments below. Do check out other useful guides on our website.

Read other similar articles:

- How to Check Status and Pay E-Challan Online

- How to Check Driving License DL Status Online

- How to Check Vehicle RC Status Online

- How to Check TDS Credit Online

- How to Check Bank Transaction History on Phone